The Domino Effect in China of Covid-19

Chinese financial markets have been very steady since COVID-19 broke out in China in late January, and equity price destruction looks very limited with A-shares down about 10% on a Year-to-date basis. Importantly, signs of financial distress within the Chinese financial system are limited.

But make no mistake, Huatai Securities’ Vice Director of Research and Fixed Income Economist, Jiqiang Zhang, believes that the COVID-19 pandemic will be the next chapter in China’s economic transformation. China’s macro story in 2020 has quickly moved from recovery from trade friction in domestic outbreak (supply-side issues from China) to the virus’ spread overseas (global demand), and a secular repositioning of global supply chains.

In 2020, We expect China GDP for the first quarter to be sharply negative, perhaps -8%, followed by -4.1% in the June quarter, then positive 6% and 5% in the second half. These will be the worst GDP numbers since 1976.

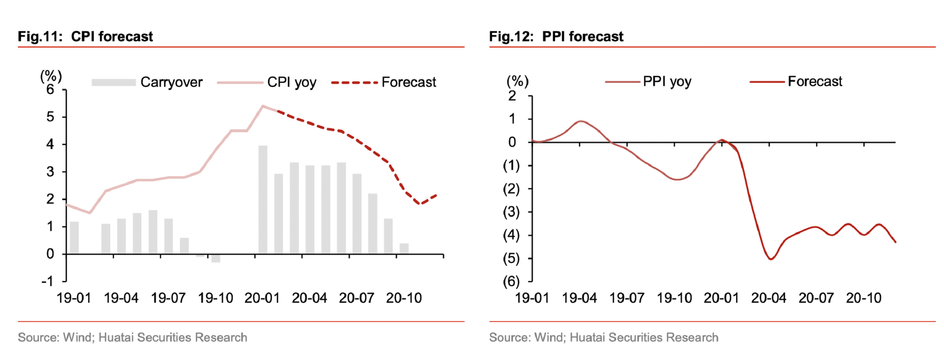

Beyond the sharp 1Q20 GDP drop, the recovery in 2-4Q and 4Q for China is increasingly at risk from weakening global demand. We expect countercyclical measures to ramp up in the face of these challenges. China fiscal policy could be more proactive and effective, tax and fee cuts could be combined with investment expansion, and traditional infrastructure with new infrastructure. Look for government emphasis on new technology infrastructure that will benefit swaths of the China tech sector, including massive 5G spending. We estimate the domestic-driven CPI growth to accelerate in 2H20 after moderating in 1H20, while the global-driven PPI will fall into negative territory again.

Three Global Trends Affecting China and Forward Global Growth

Huatai’s macro team sees three predominant trends affecting the global economy, and its recovery from COVID-19: 1) Increasing budget deficits amidst secularly low interest rates, low inflation and low growth, 2) the reorganization of global supply chains, and 3) the rise of country nationalism.

Each of these trends at least in their current stages are likely to reduce global economic efficiency, and world leaders will need to avoid creating global economic stagnation. For China, it is of the utmost importance for it to proactively address the migration of its supply chain, to shore up its weakness in key technology sectors such as semiconductors, and to build up domestic demand in a structurally positive manner.

GLOBAL GDP Decline – Gauging the Downside; Huatai lower than consensus

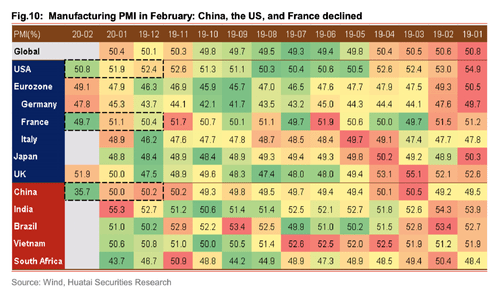

Inputs from the OECD Inter-Country Input-Output (ICIO) tables optimistically point to a more optimistic scenario of Global GDP falling by 0.4%-0.8% in 2020, similar to the global decline during the 2012 European debt crisis.

But Huatai estimates that the increasing spread of the pandemic will cause global GDP to turn down -0.7%-1.5%. The magnitude will be less than the 2008-2009 global decline of 5.66 percentage points YOY, but still substantial. China’s exports may be more likely impacted at the tail end, in the “second pass” of the global recession.

In China, secondary industries (production goods) may snap back first given labor shortages in these sectors. Tertiary sectors may take longer, but pent-up demand by a growing consumer base will be very helpful.

For China’s CPI and PPI, Huatai Securities’ expect quarterly trends to look like the following:

| 1Q20E | 2Q20E | 3Q20E | 4Q20E | |

|---|---|---|---|---|

| CPI | 5.2% | 4.6% | 3.8% | 2.1% |

| PPI | -1.1% | -4.4% | -3.7% | -3.9% |

Source: Huatai Securities Research

China’s Exports at 17% of GDP vs. 35% in 2009

On the positive side, China’s reliance for exports has changed dramatically since the GFC of 2008-2009. Exports are 17% of China’s GDP vs. 35% then.

China Policies – A Guide to Short-term and Long-term Policy Goals

We think China has more policy measures at its disposal. Foremost, China is one of the few countries in the world that still adopts a normalized monetary policy, and it still has room to reduce the interest rate and the reserve requirement ratio (RRR). In fiscal policies, China has more options, fewer constraints, and a lower budget deficit compared with other countries. A series of supply-side reforms the last two years has paved the way for the current administration to relax regulations if required.

I. Fiscal Policy Opportunities

How Much Fiscal Stimulus would be Needed?

It would take approximately RMB 1.8Tn of additional liquidity to increase GDP by 1pp, based on Huatai’s estimates. Given that 1) the GDP conversion rate for fixed asset investment (FAI) is approximately 55% and 2) this year’s GDP deflator is estimated to be close to 2%, Huatai’s economics team approximates RMB1.8tn of new investment would be needed as a result.

Where should the capital be sourced?

Local government special bonds (LGSBs) and policy-based financing could provide the main sources of capital, both of which are supported by the PBOC through pledged supplementary lending (PSL). LGSBs are a main financing tool for infrastructure projects, and the outstanding balance is expected to surpass RMB3tn and reach RMB3.5tn this year. Yet only 30% of LGSBs have been invested into infrastructure, and that will move to 70%.

Where will the capital be allocated? New Industry Emphasis amidst the Old

Huatai’s macro team believes a stimulus plan should allocate capital to conventional as well as new infrastructure – conventional spending projects (railway, road, and airport) will stabilize the economy, but the latter will assure growth in the future. Re the latter, the pandemic has exposed capacity shortages in the domestic healthcare system, and this should be an area of focus. But the concept of “new infrastructure” was first proposed in 2018 during the Central Economic Work Conference, and this movement is focused on emerging industries such as 5G networks, data centers, smart manufacturing, industrial Internet, Internet of Things, un-manned delivery, online shopping, and medical information.

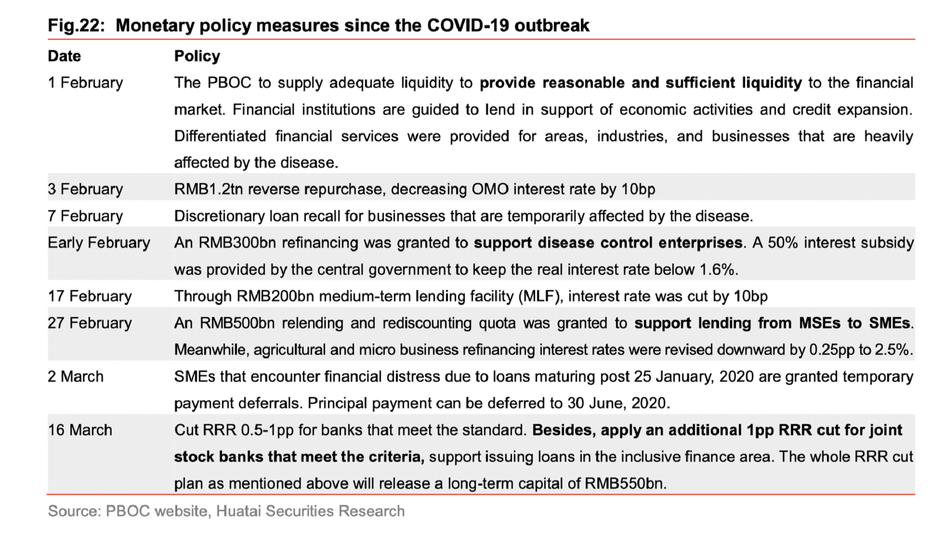

II. Opportunities in Monetary Policy:

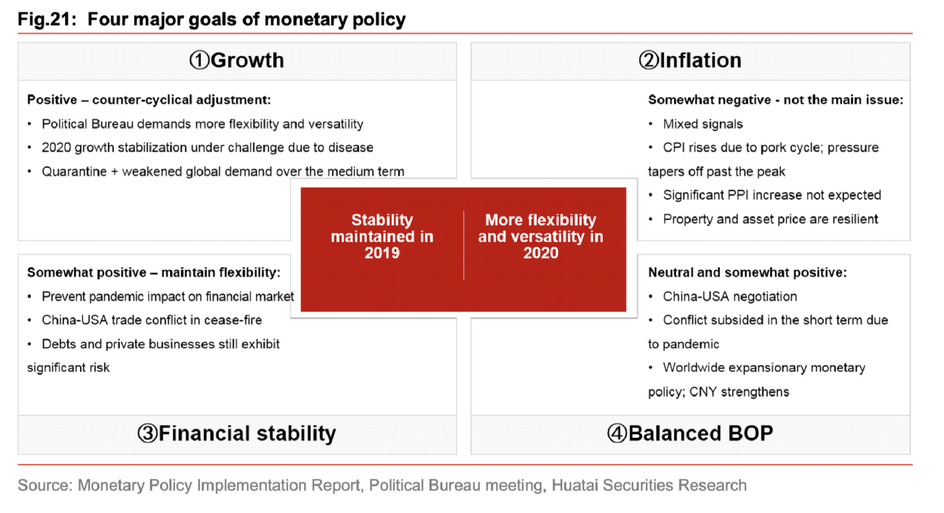

Understanding the PBOC’s four primary goals is the foundation for understanding the Chinese government’s monetary policy. Emphasis on monetary policies will shift as needed, from financial stability in 2018 “to balanced growth and stability” in 2019, to other long-term and sometimes lofty goals. But stable growth is the top priority. The COVID -19 outbreak has inarguably cast shadows over the weak recovery and undermined the government’s efforts to maintain stable growth. With COVID-19 and its unknown trajectory, central bank policy is being challenged in a new way.

Huatai’s Forecast on Monetary Measures

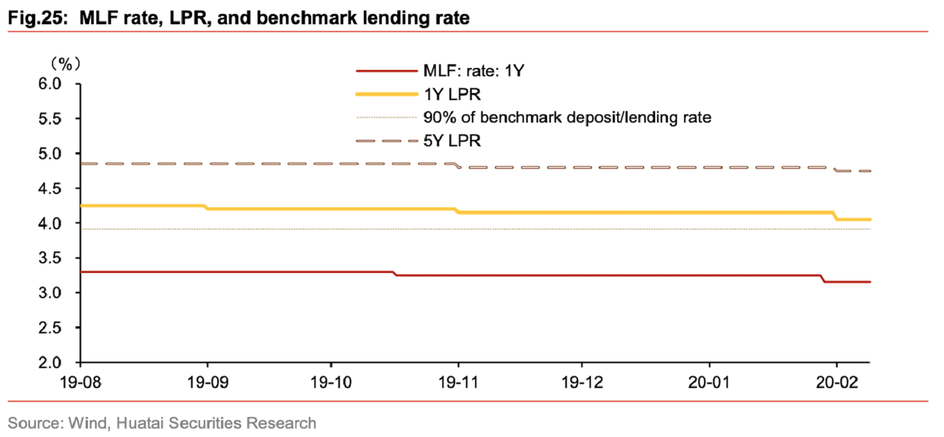

1) MLF and reverse repo rates will continue declining at a slow pace, pushing down the prime rate (LPR)

Lowering borrowing cost is the ultimate goal of a monetary measure, but the continued decline in lending rates are restrained by the banking system’s cost of liabilities. On one hand, banks show low willingness to keep narrowing LPR-MLF spread, and it is unlikely for banks to lower the LPR quotes when MLF rate remains unchanged. On the other hand, implicit rate floors still persist in the credit market. The root cause behind this lack of flexibility is the rigidity of banks’ liability costs and the reality that commercial banks are unable to tolerate negative net interest margins. To reduce cost, we expect further rate cuts on reverse repos and MLF. Note we do not think the PBOC will want to “shock” the markets that could induce panic, as the market saw globally in February. But we expect downside of about 20-35bp for MLF and open market operation (OMO) rates throughout the year, which will continue to guide LPR lower.

2) RRR – Following the RRR cut of .5-1pp on March 16 (the PBOC also offered an extra RRR cut of 1pp for eligible joint -stock commercial banks to support lending to inclusive finance -related areas), For three reasons, Mr. Zhang and his team think another RRR cut is needed in April or May:

- Corporate borrowing tends to occur from March and April onward, and releasing liquidity in advance may create idle capital, which is perhaps the reason why the PBOC had held off RRR cut in February;

- There tend to be seasonal liquidity shortages in the Spring related to new fiscal-year issues, and this tends to support a RRR cut.

- With 1Q20 GDP growth and other key datapoints coming, the PBOC should be prepared to cut RRR in an attempt to restore market confidence. We think It is possible for the RRR cut to occur in coordination with Open Market Operations to more effectively reduce LPR, in our view.

3) Benchmark 1-year deposit and lending rates – A cut may occur, but Huatai’s fixed income team expects very little impact from a reduction here for four primary reasons detailed in his late-March report.

Our Fixed income team writes in detail about its fixed income strategic recommendations, spanning government bonds, rate bonds, corporates, and single-name convertibles.

For more details, request the report by Huatai Securities, “2020 China Insight: The Domino Effect of COVID-19”, Published March 22, 2020.