China Economic Outlook 2023 – Covid-Waning to Lead a Domestic-driven Growth Rebound

For investors, the economic drivers in 2023 will be very different from what they saw in 2022, with important investment implications across consumption and manufacturing that should affect investor sector allocation significantly. China will continue to show countercyclical trends vs. the global economy, as evidenced by our CPI/PPI forecasts of 1.9%/0% in 2023.

Key Points

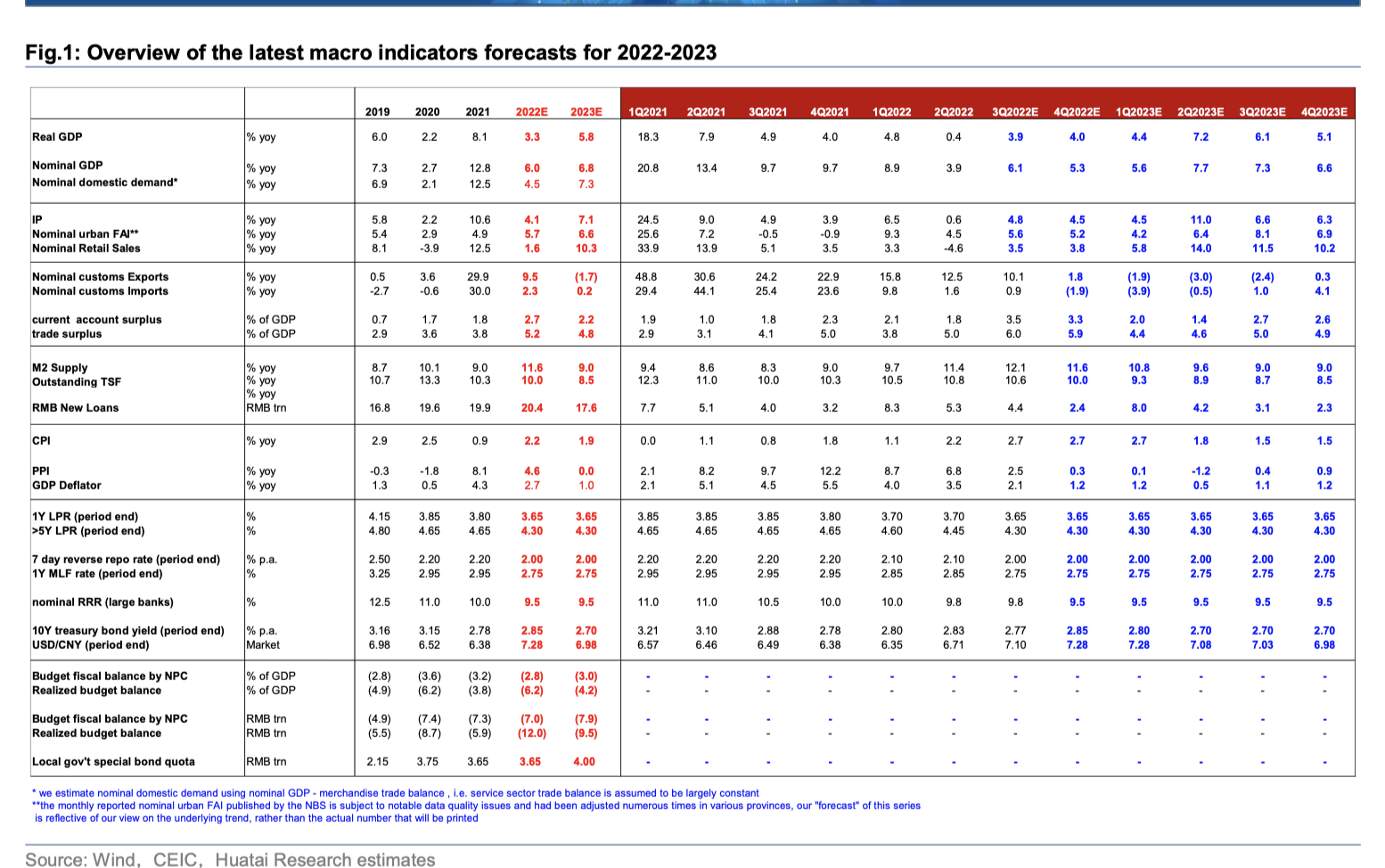

We expect real China GDP growth to expand to 5.8% in 2023 after just 3.3% growth in 2022. Huatai estimates YOY growth rates on a quarterly basis should likely peak in 2Q23 at 7.2% with 3Q23 and 4Q23 Real GDP Growth rates of 6.1% and 5.1%, respectively.

Important Shift from External to Domestic Demand in 2023 – In 2022, overseas external demand supported China’s economy by as much as 2 percentage points of its 3.3% growth. However, in 2023 we expect external demand’s contribution will be a net negative for our 5.8% forecast due to a GDP slowdown abroad.

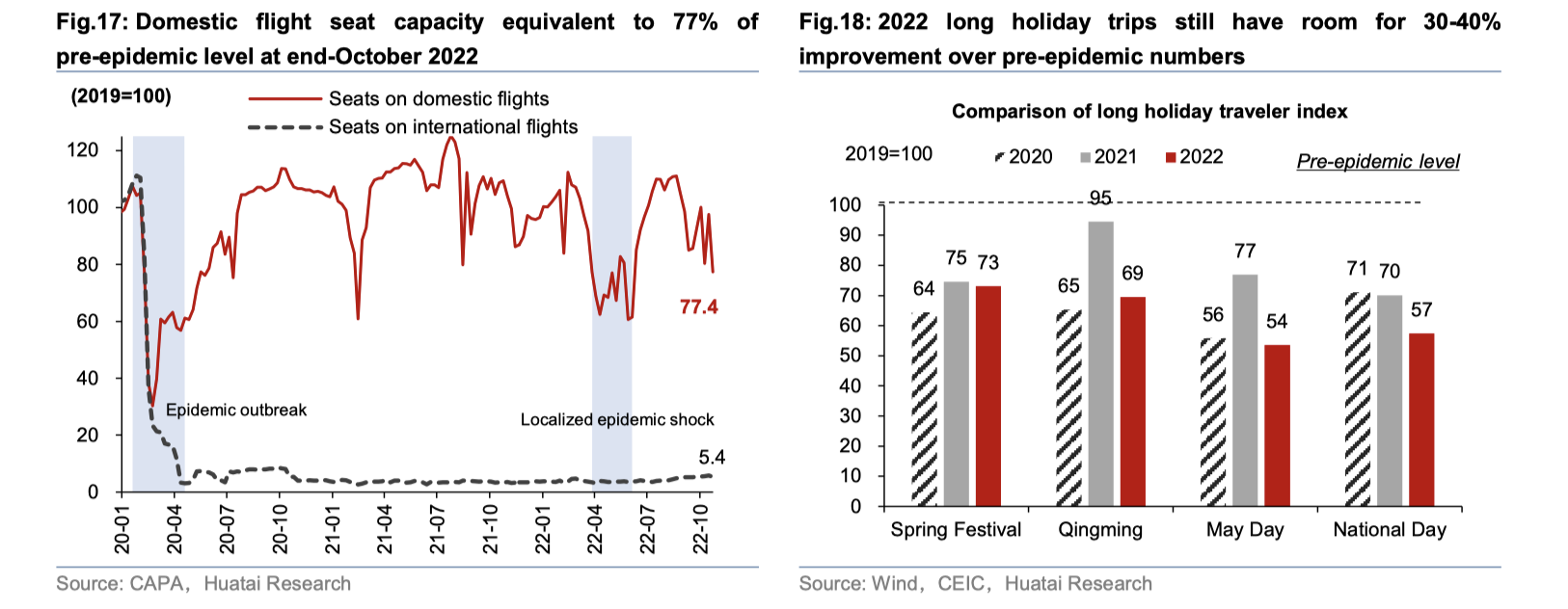

Driving our forecast is our assumption for higher employment and income levels emanating from a “Covid-waning scenario” which will boost the services sector and raise the discretionary incomes of China’s enormous “floating population.” These lower and middle-income workers will spend money on services and experiential consumption. Different sources of China consumer data show that the average savings of Chinese households has risen 20-30% since Covid began in 2020, presenting a pent-up demand situation. Quantitatively, we expect domestic-travel indicators to recover to 90-95% of pre-pandemic levels for full year 2023.

Key to our recovery scenario is our assumption that Covid’s negative impact will begin to wane in 2023. Policy indicators, healthcare developments, and general population trends are all part of our rationale. This recovery in consumer activity and sentiment will also be critical to stabilizing the property and housing market. In fact, a consumer recovery will be even more important than the wave of property-market stabilization measures we expect to see for generating what we estimate will be a “moderate rebound” of the real estate sector. We see clear signs of pent-up demand for both first-time and “upgrade” buyers.

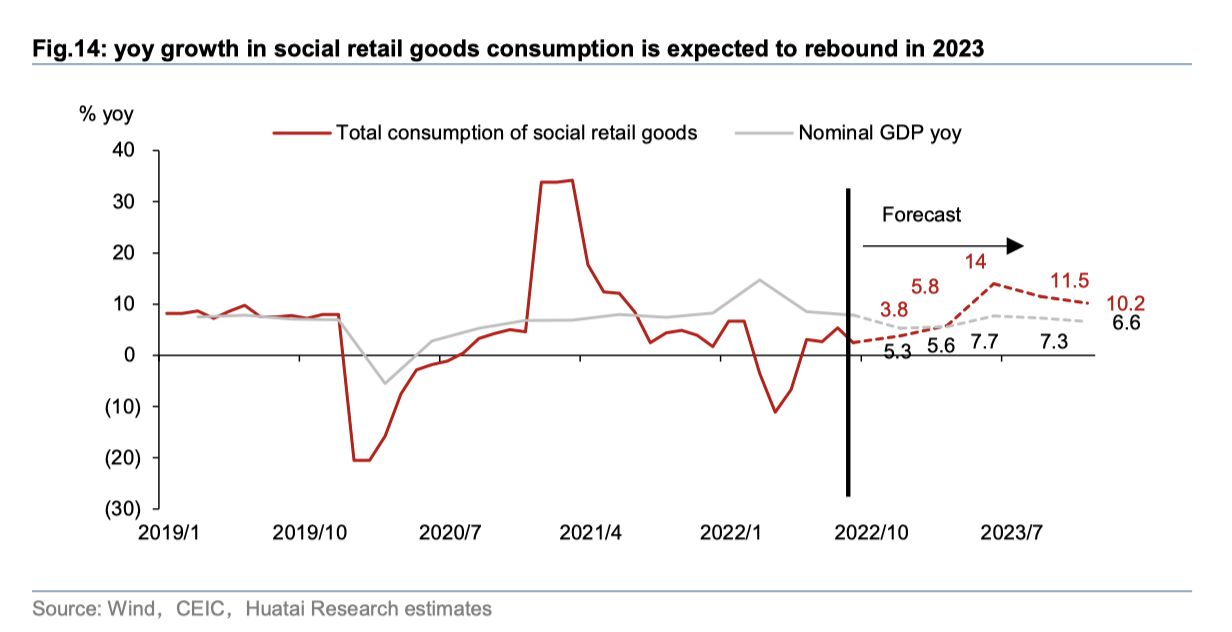

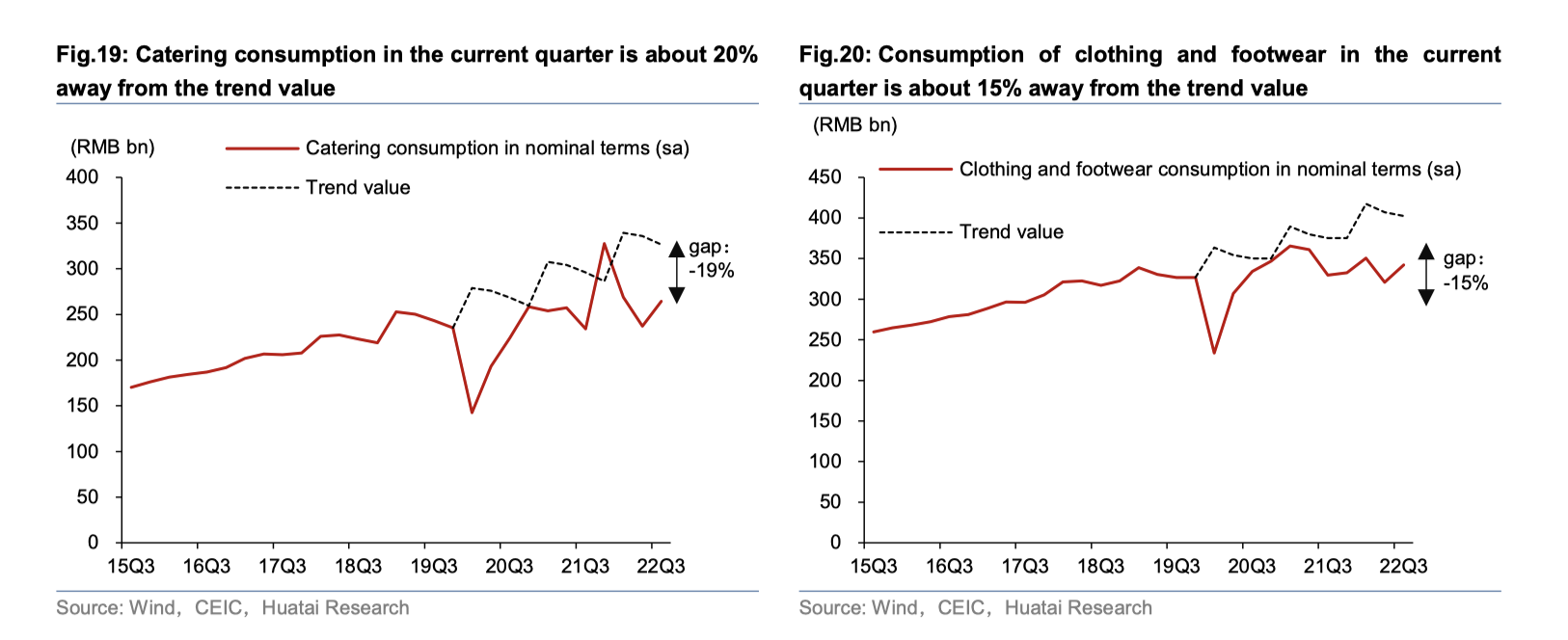

Chinese Consumption Outlook

Given the low base effects of a weak economic year in 2022, we estimate full-year growth in total retail sales of consumer goods to jump 10% in 2023. We expect quarterly growth to peak in 2Q23 and stay stable in the second half of the year. Some of the worst consumption trends in the past two years have been in just the recent quarter. Passenger traffic in this past fall’s National Day holiday was less than 60% of pre-pandemic levels and down 36% YOY. We expect consumption activity to pick up significantly with the recovery in traveling. Experiential consumption such as dining, mass discretionary consumer goods such as apparel, and family travel will likely recover rapidly in 2023.

Negative Situation for China Autos in 2023

However, the strength of the auto sector in 2022 that we saw should give way to weakness in 2023. Output has been exceeding demand by about 10 percentage points or more for the past 3 months, and energy cost-related indicators should drive less demand in the near term.

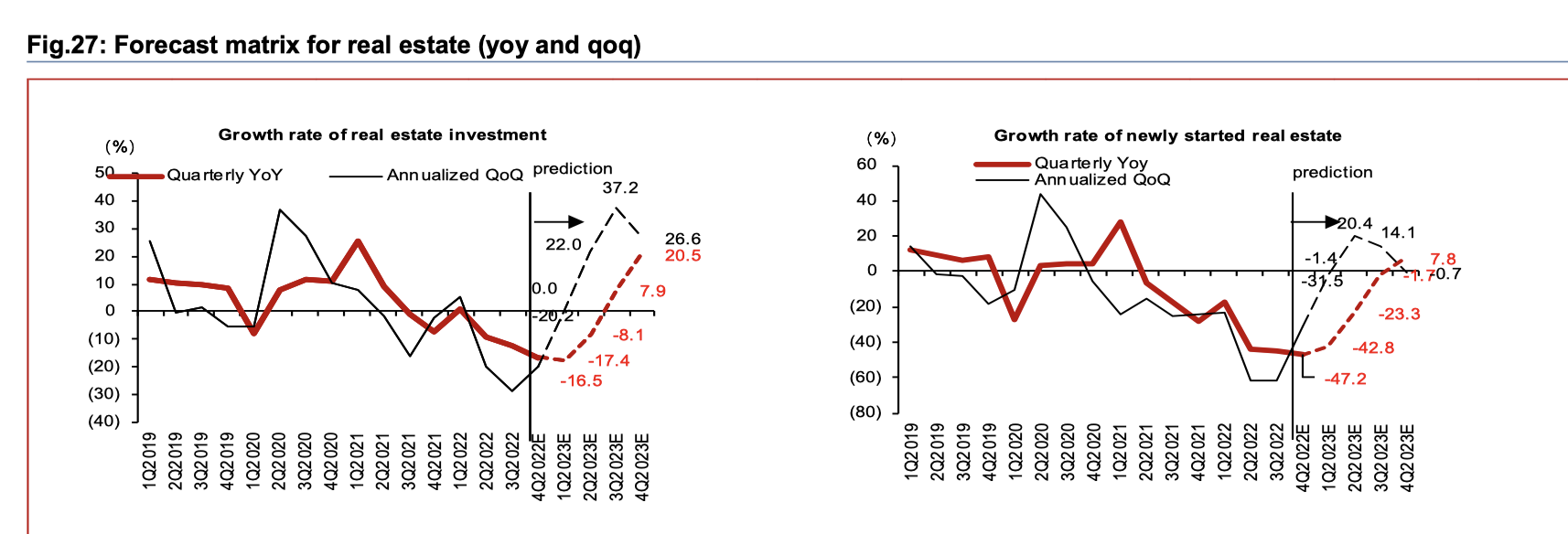

Property – GDP drag of 3-4PPTs in 2022, but likely to boost GDP by 1-2PPTs in 2023

We still see a close, cyclical relationship between China property sales, funds available for developers, and investment. Look for nationwide property investment to improve marginally in 2023, with yoy growth picking up from around -10% in 2022 to 0-5% in 2023.

In terms of demand, we expect nationwide property sales to rise by 5-10% yoy by value/area in 2023, higher than the -20% to -25% in 2022. In terms of supply, we expect yoy growth in sales payment collections by developers nationwide to improve from -20% to -25% in 2022 to 5-10% in 2023, thus narrowing the yoy decline in new starts from 40-45% in 2022 to 15-20% in 2023.

From March to October 2022, 15 policy measures were put in place to improve the property sector to limited effect. But we think the additional measures announced since November 1 show a sense of increasing urgency to support China’s real estate sector, the most important measure being the statement advocating for equal loan access for both private and state-owned real estate companies.

Sector-wise, beneficiaries of a property-related consumption rebound include furniture, home appliance, and home decoration materials providers. For reference, these three property-related retail sectors contributed about 5% to China’s GDP in 2021. We think these sectors will see a recovery 1-2 quarters after property sales rebound which we project to occur in 2023.

Manufacturing & Investment

Huatai estimates a 10% rebound in consumption as above, but manufacturing investment should be up 10-15% in 2023, as strong or stronger, despite an overseas slowdown and lower domestic inflation. China infrastructure spending should also rise 5-10% in 2023.

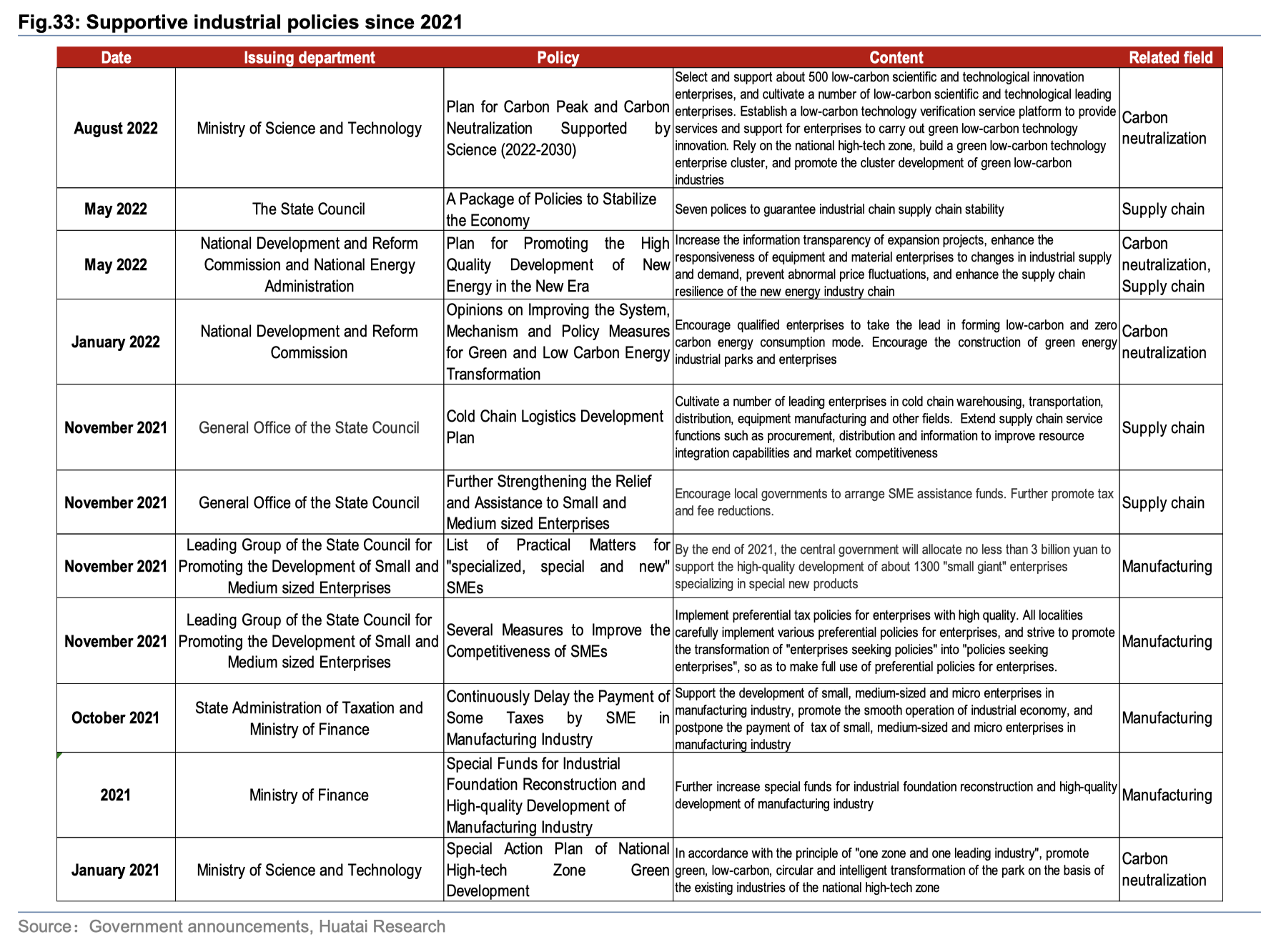

Industries in China that will continue to benefit from medium-term industrial policies are new energy, high-end manufacturing, supply chain development, and aerospace. In terms of supply-chain development, China has also experienced significant disruption during COVID across high-tech, energy, healthcare, and agricultural sectors which is spurring numerous initiatives to make their system also more resilient.

Sample of 11 government programs to support industrial development since 2021

Inflation – Bucking the Global Trend

We expect China’s CPI and PPI growth to fall in 2023 – we expect CPI growth to fall from 2.2% in 2022 to 1.9% in 2023, given easing food inflation pressure and low levels of non-food inflation. Even with a bigger than expected consumption rebound, the CPI should remain at a low level.

Importantly, PPI growth may drop from 4.6% in 2022 to nearly zero in 2023, but we do not rule out the possibility that PPI growth may turn negative in 2H23. Huatai believes global oil prices will remain elevated in 2023, with US inventory rebuilding and keeping demand elevated. But globally weak economies will keep Chinese rebar, iron, and other materials weaker.

The Trend for Monetary Policy and the RMB

As rates rise globally, we expect the People’s Bank of China (PBOC) to be reluctant to reduce interest rates. However, the PBOC will deploy structural refinancing as a countercyclical tool to boost base money supply, to support new infrastructure, and to meet capital needs in property financing and delivery. We do expect the PBOC to lower the RRR by 25bp to supersede MLFs and supplement liquidity in 4Q22. We continue to project that RMB weakness remains a function of the US Dollar. We expect the RMB should rebound from 2Q23 as the US dollar peaks out and we estimate the RMB will be at its strongest in 4Q23 at Y6.98.

Huatai China Economic Forecast November 2023

Patrick L. Springer,

PatrickLSpringer@htsc-us.com